About

Introduction

An insurance cooperative is a subtype of the business entity, which allows to offer services as an insurance provider. The Insurance Union is created by its members and the main task is fair pricing for its members.

Each member has 1 vote, regardless of the size of the share capital contribution.

Before World War II, the market share of cooperative insurers in Estonia was 40%. Today, the market share of insurance cooperatives is the same in European countries with a higher standard of living than Estonia.

Goal

Increase the market share by 1% per year and become the leader of the Estonian non-life insurance market in 20 years.

Vision

Create an insurance cooperative that offers customers insurance solutions based on their needs and pays members a dividends.

Mission

To offer members optimal insurance solutions based on their changing needs and to offer employees the greatest opportunity for self-fulfillment in the Estonian non-life insurance market.

Insurance services

2022. since, we have been offering insurance services suitable for both private and business customers as an insurance intermediary.

As soon as the capital required for the license of the insurer is together, in the first year we will bring the 4 services with the highest turnover to the Estonian non-life insurance market: home insurance, company property insurance, traffic insurance and comprehensive kasko insurance. In addition, travel insurance and machinery and equipment insurance. Why? This is because the share capital requirement is lower when starting with so-called standard services.

After that, we will continue to introduce standard services to the market, but services based on the needs of members will be added, the final list of which will be approved by our Council. Examples of such services are hunting insurance, animal insurance, forest insurance and insurance against occupational diseases.

Reinsurance

During the first three years of operation as an insurer, the reinsurer’s share in our economic activity is large. We compensate small and medium losses together with reinsurers: more reinsurers, less Insurance Cooperative Üks. Large losses are covered only by reinsurers.

Mutual Insurance company founders

The founders of the mutual insurance are the Estonian Hunters’ Society, the Estonian Chamber of Agriculture and Commerce, the Estonian Owners’ Association, The Estonian Union of Co-operative Housing Association, the Estonian Farmers’ Association, the Tartu Credit Union, the Estonian horticultural Union, the Estonian Accordion Association, 2 companies and 13 private individuals.

Look at all Insurance cooperative founders

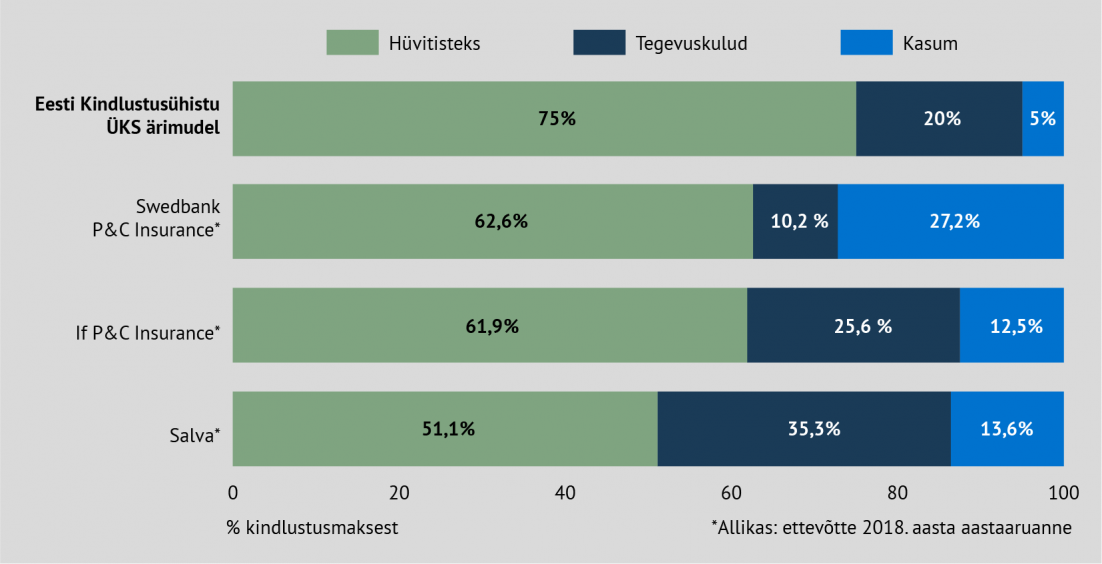

Insurance cooperative compared to insurance companies

Amount of share capital

The goal is to collect a total of 7 million euros in installments. Then we can immediately start offering all non-life insurance services. A smaller number in the range of 6.5 – 6.9 million euros will most likely be enough, but it is better to collect a little more. The final amount of share capital is confirmed by the Estonian Financial Supervision Authority during the application for an operating license.

If we collect less than 6.5 million euros as share capital, but more than 5 million euros, then we can start offering property insurance and personal insurance services. Major property insurance services in the Estonian non-life insurance market are, for example, home insurance and company property insurance. Examples of personal insurance services are travel insurance, health insurance and accident insurance.

If the collected amount is less than 5 million euros at the end of the share capital collection period, we will start collecting the missing amount of money in cooperation with crowdfunding platforms.

If even in cooperation with crowdfunding platforms, the necessary share capital amount cannot be collected, we will refund 100% of the share capital installments paid by them to the members.

Insurance cooperative market launch schedule

- Amendment of the Act on Insurance Activities Law.

Done, in force since 02.03.2019. - Establishment of an insurance cooperative without an activity license.

Done, registered in business registry of Estonia on 15.01.2020. - Starting economic activity as an insurance broker.

since 01.02.2022. - Collecting the share capital required for the license of the insurer.

Until 30.06.2023. - Applying for an operating license and starting development activities.

It starts as soon as the share capital together. Planned time 6 months - Starting to offer insurance services, first insurance policies.

It starts as soon as the operating license is in hand and the software solution is ready.